CFA (Chartered Financial Analyst) Exam Tutoring

Table of Contents

Prep for a Finance Career

If you’re interested in a career in finance or the investment management industry, there are many possible paths you can take involving different standardized tests and certifications that may help you advance in various financial careers. However, none are as targeted toward investment management as the Chartered Financial Analyst exam, otherwise known as the CFA. At MyGuru, we strongly believe that the CFA is an excellent springboard toward a career in investment management.

The CFA is designed and administered by the CFA Institute. Unlike standardized tests such as the GMAT, SAT, and ACT—which generally focus on skills more than knowledge—the CFA tests both skills and knowledge. On the skills side, the CFA tests your analytical skills, practical application skills, critical thinking, and quantitative skills. On the knowledge side, the CFA covers a vast range of investment management-related topics, which touch on finance, economics, quantitative methods, and investment analysis. Some of the key subject areas include ethical and professional standards, financial reporting and analysis, corporate finance, equity and fixed income analysis, and portfolio management and wealth planning. The CFA also tests candidates’ knowledge of key concepts and theories, including risk management, derivatives, and alternative investments. Further, there are three levels of the CFA exam: I, II, and III, all of which must be taken and passed separately, and in sequential order.

At MyGuru, our expert tutors can help you enhance your skills, build your knowledge, and learn how to apply them to the CFA exam specifically. Furthermore, our tutors have a demonstrated track record of success in helping candidates pass all three levels of the exam. They can work with you to design and execute a customized study plan that will help you pass the CFA and launch your investment management career.

The MyGuru Edge for CFA Prep

One of our most important guiding principles at MyGuru is that tests may be standardized, but students aren’t. Our CFA tutors recognize that every student is different, with unique strengths, weaknesses, goals, learning styles, and more. MyGuru CFA tutors specialize in providing personally tailored test prep guidance that will help you maximize your scoring potential. Our CFA tutors not only offer expertise about the exam’s content, but also about the very process of education and test prep. This means they can work with you to build a uniquely targeted study plan with a personalized learning approach that will help you identify and achieve your personal scoring goals.

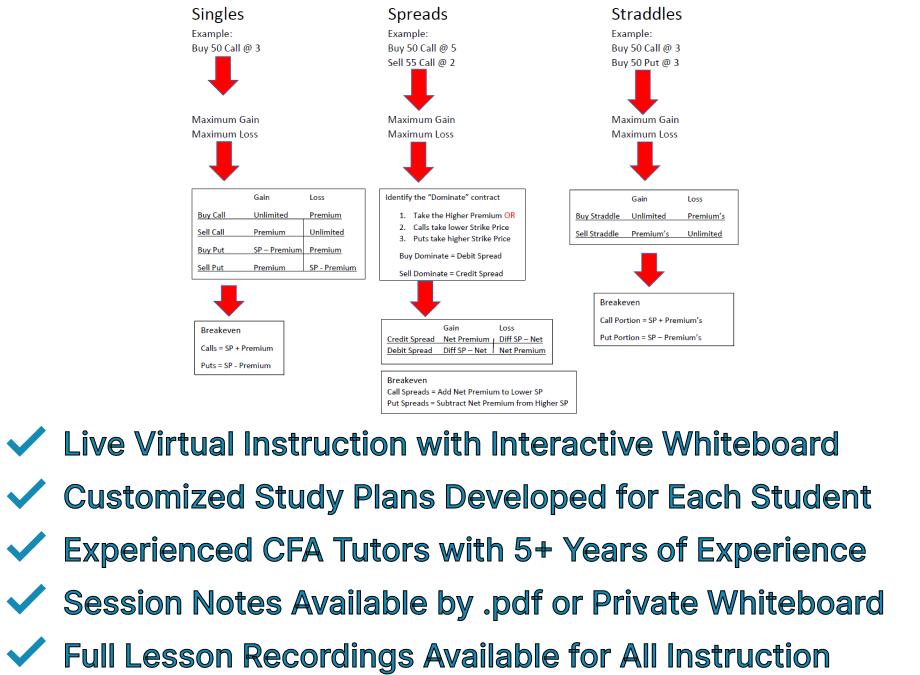

Using dynamic online whiteboarding tools in a virtual meeting environment that requires no equipment other than an internet-connected computer with a microphone and camera, MyGuru CFA tutoring features both content review and live practice problems. This parallel track of instruction allows our tutors to explain how particular CFA strategies and tactics can be used for future problems with similar content.

The instructor’s live-produced whiteboard notes are then shared as either a static .pdf (see example) after every session or kept on a private whiteboard for future reference and interaction in between lessons. Over time, these notes will become a supplementary “textbook” of targeted tactics and content to review that is unique to each student’s lesson plan and learning style that isn’t available anywhere else.

Request a CFA Exam Tutor

Customized CFA Study

Choosing a CFA tutor is a significant decision and represents an investment in your future, which is why we offer a complimentary 15-minute introductory videoconference with any potential instructor. This session helps each student determine the best path forward for their unique CFA and financial career needs. While phone calls are an option, we recommend a videoconference as it provides a better platform to showcase what makes MyGuru stand out from other CFA and finance-related test prep companies. During this videoconference, potential students will have the opportunity to:

- Share their screen live with an experienced MyGuru CFA coach to see how our dynamic whiteboarding tool operates and to understand the distinctions between our standard and premium online tutoring services

- Discuss a customized CFA study plan and explore additional resources that can support continued learning through carefully designed homework assignments and study plans between live sessions

- Provide details about their past experience with the CFA or other standardized tests they have taken or wish to prepare for, offering a comprehensive context for their tutoring needs

- Engage in a comfortable introductory conversation with their prospective CFA tutor to assess personality compatibility and the tutor's suitability to guide their CFA preparation journey

CFA Tutoring Pricing & Package Options

MyGuru’s approach prioritizes a high return on investment, allowing you to begin with just one hour of instruction without any required long-term commitment. We offer various tiers of instruction and hours designed to maximize value. Our students consistently achieve a passing score on all three levels of the CFA exam, which is necessary to earn the CFA designation and to secure high-paying positions with leading employers. Additionally, many of our students continue to excel by passing further finance-related exams, including the CFP, FRM, CAIA, CPA, and others.

- Standard Online | $130 per hour | $600 for 5 hours | $1,400 for 12 hours | $2,700 for 24 hours

Our most budget-friendly option, significantly more affordable than our well-known one-on-one tutoring competitors, is MyGuru Standard Online CFA tutoring. This service is customized to each student's needs by an instructor with extensive tutoring experience. Additionally, students receive a PDF of each session's whiteboard notes via email within 24 hours. Invest in standard online CFA tutoring by clicking here. - Premium Online | $200 per hour | $900 for 5 hours | $2,100 for 12 hours | $4,000 for 24 hours

Our best value option is MyGuru Premium Online CFA tutoring, which includes full recordings of every session and remains accessible for up to three months after the final lesson. It also features a private interactive whiteboard where students can demonstrate tactics live during lessons and post questions or comments between sessions to stay in touch with their instructor. Instructors check the board daily to respond as needed. - Expert Edge Online | $250 per hour | $1,125 for 5 hours | $2,600 for 12 hours | $5,000 for 24 hours

Seeking large score improvements or top decile results? Consider Expert Edge Online tutoring with George Beshara, our most senior CFA tutor. George has been teaching financial and accounting students both at the university and graduate-school levels, as well as one-on-one. He leverages his pedagogical expertise to empower his students to make the most of their tutoring investment.

Our tutoring packages are designed to be flexible, allowing for regular lessons of 60, 90 (most common), or 120 minutes based on student availability and preference. Once a package is purchased, any additional time is billed at the prorated hourly package rate. We also offer refunds for unused hours, minus a 5% processing fee, as long as at least 24-hour notice is given for any reschedule or cancellation.

While not recommended for the computer-administered CFA exam and lacking the dynamic features of our online tutoring, in-person instruction is available in many major US cities upon request, at the same price as our Premium Online instruction, subject to tutor availability.

Your CFA Tutoring Guru

Our CFA tutoring team is spearheaded by George Beshara, CFA. George possesses extensive experience working in financial advisory roles with leading companies, in addition to significant educational experience as a professor as well as a one-on-one tutor. This dual industry-education experience is what gives George—and our entire CFA team—an edge. George draws from his firsthand knowledge of how the CFA’s curriculum is applied in real-world contexts, while also drawing from his pedagogical training as a university professor. These allow him to quickly assess exactly where students are at in their CFA journey, and to design a 100% customized study plan that builds on their strengths and targets their growth areas with maximum efficiency.

After beginning his career as a Senior Equity Research Analyst with Pharos Holding, George served as a Senior Financial Analyst and then a Financial Planning and Analysis Manager at Edison International. From there, he moved to AWP Safety, a PE-backed Firm, where he currently serves as the Director of Financial Planning and Analysis. This managerial experience means that he can offer expert coaching beyond the content of the CFA as you chart your financial advisory career.

Along the way, he’s managed to pass his education along to countless students. He is currently a Corporate Finance professor at Pepperdine Graziadio Business School and University of La Verne. But above all, he most values the time he spends working one-on-one with students to help them prep for the CFA. George loves getting to know and uplift ambitious young financial advisory professionals at this crucial moment in the beginning of their career journeys. Nothing leaves him more satisfied than finding out that his students have passed their CFA exams en route to landing dream jobs.

CFA Exam Overview

Level I

180 multiple-choice questions, divided into a 2h 15m morning session and a 2h 15m afternoon session.

Level II

22 case studies of four questions each, divided into a 2h 15m morning session and a 2h 15m afternoon session.

Level I & II Topics: ethical and professional standards, quantitative methods, economics, financial reporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management and wealth planning

Level III

One 2h 15m morning session of 8-12 essay questions, and one 2h 15m afternoon session with 11 case studies and four questions each.

Level III Topics: ethical and professional standards, behavioral finance, private wealth management, institutional wealth management, capital market expectations, asset allocation, fixed income portfolio management, equity portfolio management, derivatives and risk management, and alternative investments

Exam Scoring

Each multiple-choice and case study question correct answer earns one point, with no penalties for incorrect answers. Your score is the total of your correct answers.

Level III essay questions are graded by CFA charterholders based on the correctness and completeness of the response.

Each level of the CFA exam is taken pass/fail. The Minimum Passing Score (MPS) is unique to each exam and is determined by the CFA Institute Board of Governors, based on data from the exam itself.

In addition to the pass/fail result, CFA exam candidates earn a performance summary that assesses their performance relative to other exam candidates.

Why Take the CFA Exam?

If you’re interested in working in a financial role or in the finance industry, there are many possible standardized tests you might take. Many others proceed without obtaining any professional certification at all. So why might it be worth investing the time and energy necessary to pass the CFA?

First, taking the CFA can be an excellent move for advancing your career prospects. Many employers in the finance industry prefer the CFA to other exams, especially for higher-level positions, and some may even require CFA designation for applicants to qualify.

The CFA is prized because of its difficulty and its historically low-pass rates. This means that passing all three levels offers individuals a level of prestige that other exams don’t. Additionally, the CFA includes a uniquely comprehensive financial curriculum, meaning those who pass have demonstrated broad expertise in the finance and investment fields, in addition to the commitment and discipline necessary to successfully pass the exam.

That comprehensive curriculum means that the CFA is a highly versatile exam. It’s especially relevant for roles like portfolio managers, research analysts, fund managers, and asset managers, but it can also help you land positions in the fields of corporate finance, risk management, financial consulting, and wealth management.

Additionally, becoming a CFA charterholder allows you to gain access to a global network of qualified and respected professionals. This can be an invaluable asset throughout your career.

Proven CFA Study Strategies

The CFA’s comprehensive curriculum also means that it’s a particularly challenging exam to study for, and requires a rigorous commitment. Preparing for a standardized test such as the CFA is more like preparing for a marathon than cramming for a final exam, so the first step is to commit to 1-2 hours of daily dedicated practice for at least six weeks.

The best resources to begin practice can be found directly from the CFA Institute, the organization that administers the CFA. Take a free mock exam to determine your baseline score and learn how far you have to go to achieve your goal as well as what topics should be prioritized for study. That link will also take you to additional practice questions to help kickstart our CFA prep.

You'll want to procure a package of online problems for regular drills and each practice set should be fully self-reviewed to ensure that you are getting the most out of every exercise. Make sure to take a break between doing and self-reviewing your practice to avoid simply accepting an answer explanation rather than challenging yourself to determine why your answer was incorrect, while the correct answer was right instead.

Self-Paced CFA Study Option

While we believe customized CFA tutoring is the most efficient way to prepare for the CFA, it is a significant financial commitment. Our partner Analyst Prep offers a unique video-based self-paced CFA prep approach that can supplement 1-1 CFA tutoring and form the core of a self-study program.

Finance Career News & Professional Certification Exam Tips

Finance & Accounting Exam News & Strategy

Phone

Chicago: 312-278-0321

info@myguruedge.com