The Certified Public Accountant (CPA) exam is a challenging and comprehensive test that serves as a gateway to a career in accounting. Preparing for the CPA exam requires a great deal of dedication and hard work, but the rewards can be well worth the effort. In this article, we'll provide some tips and strategies to help you prepare for the CPA exam and achieve success.

Accounting Certification News and CPA Strategy

Stay current with the latest accounting certification news and proven CPA strategies.

How to Study for the CPA Exam

Signing up to sit for the CPA exam is a major milestone in your career. The long-term career benefits for earning a CPA license are clear. The Journal of Accountancy reports that newly minted CPA’s earn a $66,000 average salary and more experienced CPAs with 20 years of experience can earn up to $152,000.

Signing up to sit for the CPA exam is a major milestone in your career. The long-term career benefits for earning a CPA license are clear. The Journal of Accountancy reports that newly minted CPA’s earn a $66,000 average salary and more experienced CPAs with 20 years of experience can earn up to $152,000.

What I Would Have Done Differently to Study for the CPA Exam

Earning your CPA license can give your career a jumpstart. You will gain a significant advantage over the other accountants who don’t possess this credential. According to the 2019 Robert Half Salary Guide for Accounting and Finance Professionals, the midpoint CPA salary for tax professionals with one to three years of experience is $57,500, with auditing experts making $52,000. As you climb the organizational ladder, you can expect to earn substantially more. At the level of Manager of Tax Services, you could be making $104,000 annually! At the upper end of the salary range, your yearly compensation could even be as much as $164,250.

Earning your CPA license can give your career a jumpstart. You will gain a significant advantage over the other accountants who don’t possess this credential. According to the 2019 Robert Half Salary Guide for Accounting and Finance Professionals, the midpoint CPA salary for tax professionals with one to three years of experience is $57,500, with auditing experts making $52,000. As you climb the organizational ladder, you can expect to earn substantially more. At the level of Manager of Tax Services, you could be making $104,000 annually! At the upper end of the salary range, your yearly compensation could even be as much as $164,250.

What is the CMA Exam?

In the previous article on the CMA certification, we discussed the steps to become CMA certified such as fulfilling the examination, education, and experience requirements. In this article, let us take a closer look at the CMA exam itself, including exam specific content, recommended preparation time, sequence of taking the two parts, exam preparation strategies and so on.

In the previous article on the CMA certification, we discussed the steps to become CMA certified such as fulfilling the examination, education, and experience requirements. In this article, let us take a closer look at the CMA exam itself, including exam specific content, recommended preparation time, sequence of taking the two parts, exam preparation strategies and so on.

What You Need to Know About Earning Your CMA Certification

In a previous article, we briefly introduced the other three major accounting certifications that can be added on to the CPA. In this article, we will focus on one of them: Certified Management Accountant (CMA).

In a previous article, we briefly introduced the other three major accounting certifications that can be added on to the CPA. In this article, we will focus on one of them: Certified Management Accountant (CMA).

Which Accounting License Should I Add to my CPA?

The Certified Public Accountant (CPA) license is known as the most popular certification for accountants and has a reputation of the “gold standard” in the accounting industry. While many CPAs choose to practice in public accounting, a large number of them follow career paths in corporate accounting and other fields such as government, academia and the non-profit sector.

The Certified Public Accountant (CPA) license is known as the most popular certification for accountants and has a reputation of the “gold standard” in the accounting industry. While many CPAs choose to practice in public accounting, a large number of them follow career paths in corporate accounting and other fields such as government, academia and the non-profit sector.

CPA Tip of the Week: Becoming a CPA

Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats.

Just starting out on your path to becoming a Certified Public Accountant (CPA)? Unsure where to begin? One of the biggest decisions to make is the selection of a review course. Many people are familiar with Becker, Roger, Wiley CPAexcel, and Yaeger. There is also Surgent, Gleim, Kaplan, Ninja, Lambers, ExamMatrix, and more. With so many options available to a candidate, it may be difficult to determine what will work best. While some programs will boast about a high pass rate for its users, at the end of the day, the content provided is very similar --- is it simply delivered in varying formats. CPA Tip of the Week: In What Order Should I Take the CPA Exam?

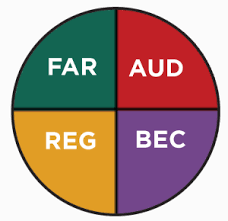

In what order should I take the Certified Public Accountant (CPA) Exam? It is a question that many new candidates ask themselves, and others, when starting off on their four-part CPA journey. While people will suggest many different approaches, those who have taken the exams in the past will mostly agree that you should not leave Regulation (REG) or Financial Accounting & Reporting (FAR) for last. There are several reasons for this. Among them, the pass rates for FAR (47.5%) and REG (49.3%) are considerably lower than the pass rates for Audit (AUD), at 52.1%, and Business Environment & Concepts (BEC), at 55.35% (all percentages as of the most recent quarter, shown here on the American Institute of Certified Public Accountants (AICPA) website).

In what order should I take the Certified Public Accountant (CPA) Exam? It is a question that many new candidates ask themselves, and others, when starting off on their four-part CPA journey. While people will suggest many different approaches, those who have taken the exams in the past will mostly agree that you should not leave Regulation (REG) or Financial Accounting & Reporting (FAR) for last. There are several reasons for this. Among them, the pass rates for FAR (47.5%) and REG (49.3%) are considerably lower than the pass rates for Audit (AUD), at 52.1%, and Business Environment & Concepts (BEC), at 55.35% (all percentages as of the most recent quarter, shown here on the American Institute of Certified Public Accountants (AICPA) website).

From FAR Away: Which Section You Should Take First

The CPA Exam is without question one of the most difficult exams on the planet. It takes proper planning and preparation to get through this daunting exam. The purpose of this article is to provide you with some tips and tricks on which section you should take first.

The CPA Exam is without question one of the most difficult exams on the planet. It takes proper planning and preparation to get through this daunting exam. The purpose of this article is to provide you with some tips and tricks on which section you should take first.

Calling the Shots - The Entrepreneurial CPA

The Skills Required for a Career in Accounting

Ten Tough Concepts Tested on CPA-FAR: The Time Value of Money

Understanding the time value of money for FAR is incredibly important. It appears in the accounting for leases, bond valuation, corporate finance (BEC), and pension accounting, just to name a few. Conceptually, it should be a very easy topic for students to master - a dollar today is worth more than a dollar tomorrow for the simple reason that with a dollar today one can consume, and without a dollar today one cannot consume. To compensate someone for delaying his or her consumption, interest is added to the principal amount (the amount of money that is being delayed). This interest represents the price of consumption today. The most common proxy used for this interest rate is the risk-free US Treasury rate. Any interest premium in addition to the US Treasury rate represents compensation for any other risk factors. This all should seem intuitive.

The AICPA does not allow the use of financial calculators on the CPA exam. Students are only allowed to use simple calculators that are provided with the testing software. This makes calculating present values and future values incredibly cumbersome and monotonous. Therefore, the AICPA relies heavily on discount factors and future value multiples to test students on these concepts. This is where the confusion ensues! Students need to be comfortable with this approach, so taking a step back and understanding the mechanics of what is going on is important. Here are some steps to take:

How To Study For The CPA With A Full-Time Job

Studying for a CPA exam while juggling a full-time job can be an overwhelming task since it requires a lot of hard work and discipline. However, while the task of learning the material is hard, it is not impossible. In this article, CPAExamGuy.com offers tips for studying for the CPA exam even when you work full time.

Studying for a CPA exam while juggling a full-time job can be an overwhelming task since it requires a lot of hard work and discipline. However, while the task of learning the material is hard, it is not impossible. In this article, CPAExamGuy.com offers tips for studying for the CPA exam even when you work full time.

Ten Tough Concepts Tested on CPA-FAR: Governmental and Non-Profit Accounting

In our first series of articles, we’ll discuss ten concepts that students often struggle with before they decide to work with a tutor for CPA-FAR. Each post will offer guidance on how to prepare to master the topic or concept discussed. In this initial post, we’ll cover governmental and non-profit accounting.

In our first series of articles, we’ll discuss ten concepts that students often struggle with before they decide to work with a tutor for CPA-FAR. Each post will offer guidance on how to prepare to master the topic or concept discussed. In this initial post, we’ll cover governmental and non-profit accounting.