In the previous article on the CMA certification, we discussed the steps to become CMA certified such as fulfilling the examination, education, and experience...

Which Accounting License Should I Add to my CPA?

The Certified Public Accountant (CPA) license is known as the most popular certification for accountants and has a reputation of the “gold standard” in the accounting industry. While many CPAs choose to practice in public accounting, a large number of them follow career paths in corporate accounting and other fields such as government, academia and the non-profit sector.

The Certified Public Accountant (CPA) license is known as the most popular certification for accountants and has a reputation of the “gold standard” in the accounting industry. While many CPAs choose to practice in public accounting, a large number of them follow career paths in corporate accounting and other fields such as government, academia and the non-profit sector.

CPAs in public accounting provide assurance and advisory services as independent outsiders, while those in non-public accounting fields work in a variety of areas inside the organization as strategic business partners of their organizations. These areas include financial accounting and reporting, managerial accounting, tax accounting, internal auditing, and so on. As different areas have different emphases on specific skills, what can you potentially add on to your CPA to strengthen your skills and become an expert in a specific field? This article will walk you through which professional certifications are available to you and which one(s) best fit your future career plans.

The Three Major Accounting Licenses

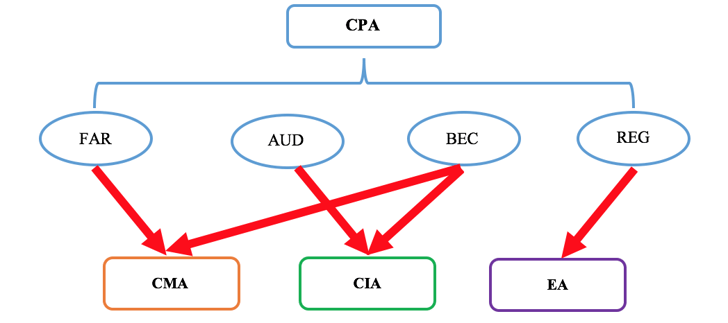

The primary purpose of most professional examinations is to measure whether the candidates have competent technical knowledge of various subjects, the ability to apply such knowledge with professional judgement, and the comprehension of professional responsibility and ethics. There are three other major accounting licenses, the grandfather of which is CPA: Certified Management Accountant (CMA), Certified Internal Auditor (CIA) and Enrolled Agent (EA). They extend CPA in many aspects, which is briefly shown in the following chart:

Now, let’s look at each of these certifications and discuss in details how each adds on to CPA and who may want to consider it.

Certified Management Accountant (CMA)

The CMA program was created in 1972 by National Association of Accountants (NAA), which later became the Institute of Management Accountants (IMA) in 1991. As shown in the previous chart, CMA extends the FAR and BEC sections of the CPA examination by specifically focusing on financial planning, performance & control, and financial decision making. Below is an overview of the 11 competencies covered in the two-part CMA examination:

|

Part One: Financial Reporting, Planning, Performance, and Control · External Financial Reporting Decisions · Planning, Budgeting, and Forecasting · Performance Management · Cost Management · Internal Controls |

Part Two: Financial Decision Making · Financial Statement Analysis · Corporate Finance · Decision Analysis · Risk Management · Investment Decisions · Professional Ethics |

According to IMA, the program has been designed to meet the evolving needs of a business or organization by focusing on skills such as strategic thinking, financial analysis, and the ability to convert data into dialogue. In other words, CMAs are trained to explain the "why" behind numbers, not just the "what". CMA opens new doors to those who aspire to careers as Financial Analyst, Budget Analyst, Cost Accountant, Finance Manager, Controller, Treasurer, Vice President of Finance, CFO or CEO. According to the IMA salary survey, the median total compensation is 67% higher for CMAs over non-CMAs globally and the median total compensation is 47% higher for CMAs over peers without the CMA or CPA in the U.S.

Certified Internal Auditor (CIA)

Established in 1941, The Institute of Internal Auditors (IIA) is an international professional association with members working in internal auditing, risk management, governance, internal control, information technology audit, education, and security. In 1974, the CIA program was created and the first CIA exam was administered. The creation of an internal audit function within business organizations stems from growing transaction complexity and volume, the separation of ownership (“shareholders”) and control (“managers”), technical (accounting) expertise required to review and summarize business activities in a meaningful way, and need for organizational status to ensure independence and objectivity. These internal management and control functions are hardly achieved simply by employing external auditors.

The fact that the external auditors and internal auditors use many of the same techniques often leads to a mistaken conclusion that there is little difference in the work or in ultimate objectives. However, the internal auditor is considered “the company man”, having a vital interest in all areas of company operations and personal incentive to help make those operations as profitable as possible. Major responsibilities of internal auditors include operation analysis, compliance review, internal control evaluation, and safeguard assurance. In this regard, CPAs and CIAs are NOT the same!

An article on Robert Half lists the reasons why someone should consider a career in internal auditing, such as high demand and strong salaries due to global regulatory changes and compliance challenges. According to the IIA’s 2017 Internal Audit Compensation Study, the average salary of internal auditors who hold one or more certifications is 51% higher than that of peers with no certifications (based on U.S. responses). Potential jobs along the career path range from entry-level positions such as risk assessment specialists, internal controls auditors and information systems auditors to medium-/high-level management such as Internal Audit Managers, Internal Audit Director, Chief Audit Executive (CAE), and Chief Risk Officer (CRO).

As shown in the previous chart, CIA extends the AUD and BEC sections of the CPA examination. Here’s an overview of content of the three-part CIA examination:

|

Part 1: Internal Audit Basics · Mandatory Guidance · Internal Control/Risk · Conducting Internal Audit Engagements – Audit Tools and Techniques

Part II: Internal Audit Practice · Managing the Internal Audit Function · Managing Individual Engagements · Fraud Risks and Controls |

Part III: Internal Audit Knowledge Elements · Governance/Business Ethics · Risk Management · Organizational Structure/Business Processes and Risks · Communication · Management/Leadership Principles · IT/Business Continuity · Financial Management · Global Business Environment |

Enrolled Agent (EA)

Enrolled Agents (EAs) are tax practitioners with technical expertise in taxation and are fully authorized to represent taxpayers before all administrative levels of the Internal Revenue Service (IRS) including audits, collections and appeals. Such representations include preparing and filing documents, communicating with IRS, and representing clients at conferences, hearings and meetings. Both EAs and CPAs are allowed to practice before the IRS. Then why may someone consider getting an EA license if he/she already has a CPA? It depends on whether that person would like to specialize in taxation practices or not.

From the chart above, we can see that EA extends the REG section of the CPA exam. The EA program significantly widens and deepens the range of technical knowledge a candidate is required to comprehend. In REG of the CPA, about 60% to 80% of the content focuses on taxation topics including federal taxation of individuals, entities and property transactions. These topics have been expanded to three parts of the EA exams, with plenty new topics supplemented especially on preliminary work for tax preparation, advising individual and business taxpayers, detailed guidance on client representation, and the E-filing process. An overview of the three-part EA exam is as follows:

|

Part I. Individuals · Preliminary Work and Taxpayer Data · Income and Assets · Deductions and Credits · Taxation and Advice · Specialized Return for Individuals

|

Part II. Business · Business Entities · Business Financial Information · Specialized Returns and Taxpayers

|

|

Part III. Representation, Practices and Procedures · Practices and Procedures · Representation before the IRS · Specific Types of Representation · Completion of the Filing Process |

|

Another advantage of an EA license is that, unlike a CPA license that is registered and restricted to practice in a specific state, it is a federal license and has an unrestricted right to represent any taxpayer in any state. This allows EAs to reach out to a broader set of clients across state boarders.

Enrolled agents also have a broad range of opportunities in corporate, individual, or government employment. Some enrolled agents choose to be self-employed, to enjoy a flexible schedule and potential for better work-life balance.

In conclusion, which certification to add on to your CPA depends on your career aspirations. Those who aspire to positions as controllers or CFOs may consider CMA, while those who aspire to become audit directors or CRO may consider CIA. Those with special interests in the field of taxation may want to add EA to their title. In the next few follow-up articles, I will focus on these certifications individually, and discuss how to pass the exams and the requirements for licensing.

About the Author

Susie Duong is one of MyGuru's experienced CPA tutors, with a PhD in Accounting and many years of experience as a CPA and an educator.